Positive sustainability case study: EM corporate bonds

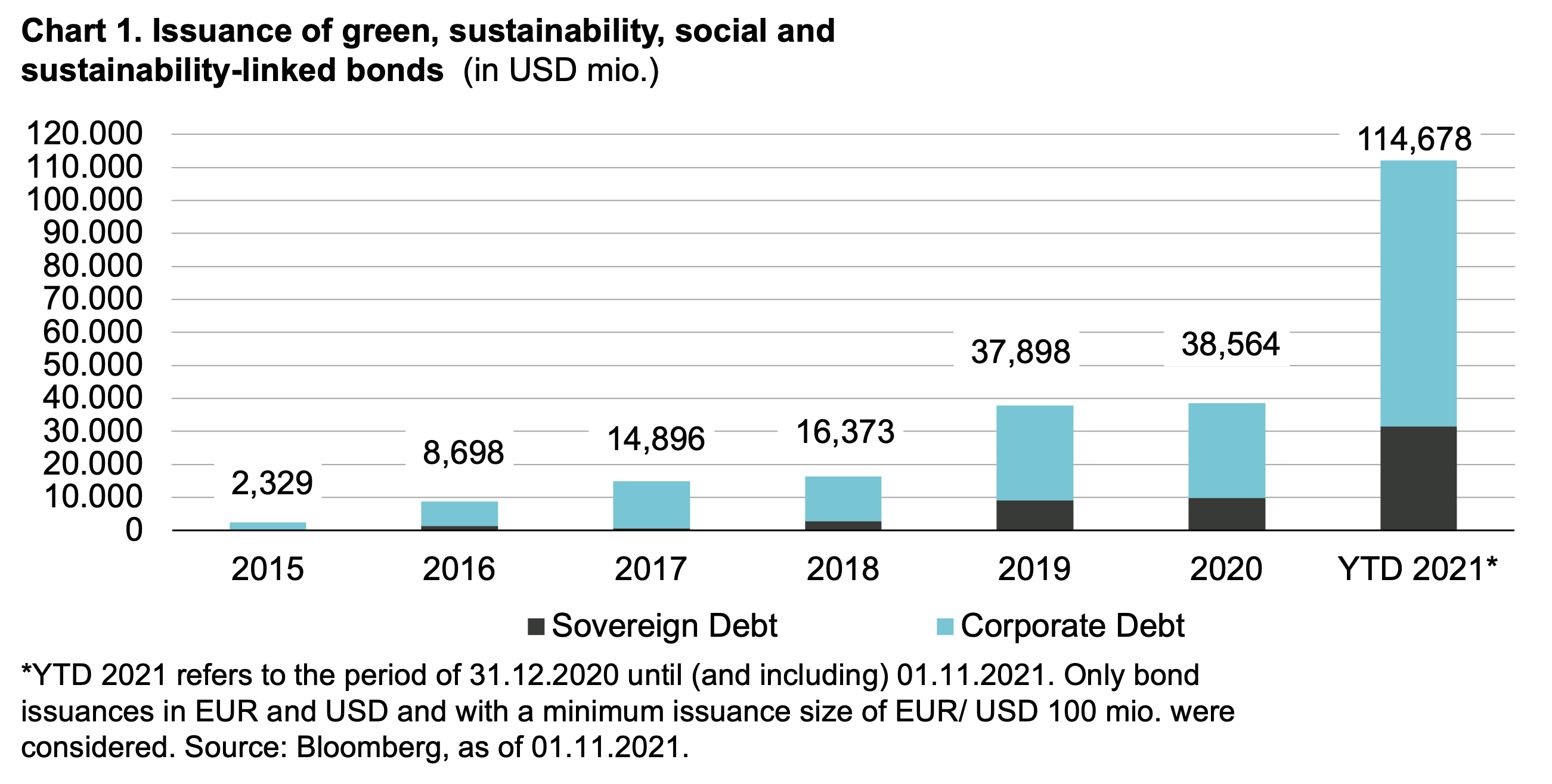

The surge in ESG investing is a global phenomenon and in recent years the growth has been formidable in emerging markets. Over the past six years in emerging markets, bonds labelled green, sustainable, and social and sustainability-linked have surged in issuance volume at a compound annual growth rate (CAGR) of more than 91%. In the past year alone, ESG-related bond issuance in emerging markets has increased from around USD 39 billion in 2020 to over 114 billion year-to-date (see chart 1).

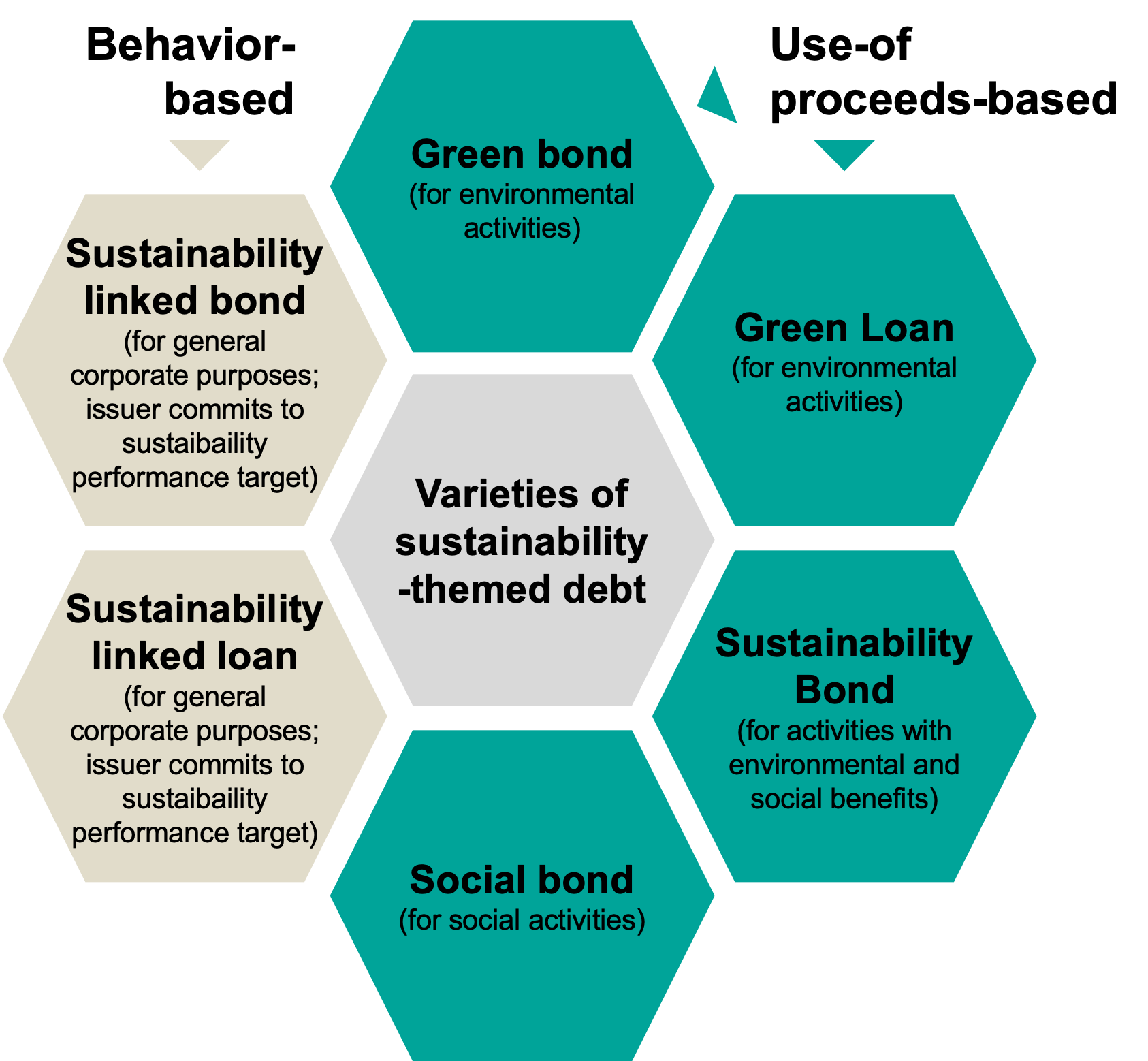

Sustainability themed bonds can be broadly categorized into green, sustainability, social, and sustainability-linked. The graphic below shows how the different types of loans and bonds on offer. As fixed income investors we buy and sell in tradable securities, therefore, our focus is on the sustainability-themed bonds.

When it comes to sustainable investing, we think active investors should aim to find those issuers where the underlying company, or country, is taking steps that propels the underlying company or country on a path to improve their ESG. Therefore, it is not a matter of “have” they reached their ESG goals, rather it’s a matter of “will” they reach those goals. We believe that by looking at where an underlying company is headed achieves two goals: 1. It rewards and helps the companies that are transitioning from non-sustainable to sustainable and 2. Provides the best potential to generate performance.

To show the opportunities available in emerging markets for sustainable-minded investors we will look at a specific case study, Chile.

Chile powers forward with its energy transition

Chile is at the forefront of the push towards greener energy. In 2019, the Chilean government announced their “National Decarbonization Plan” to become carbon neutral by 2050. The plan aims to tackle carbon emissions across industries, but the transformation of the energy generation is key to succeed in its effort. The plan has set the target to reduce the system’s dependence on coal, aiming to terminate 1’047 MW of coal generation capacity by 2024 and 100% of coal generation capacity by 2040. The government is now pushing to bring this 2040 target forward to 2025 and the Congress has already passed a bill aiming to achieve this. For the bill to pass into law requires the approval of the Senate, which is still reviewing the proposal and has yet to approve it. Regardless if the 100% reduction in production is reached in 2025 or 2040, achieving it requires substantial funding.

In Chile, the biggest single energy source is still coal. Coal-based energy accounted for 35% of total energy produced in 2020, followed by hydro-energy with 27% and natural gas with 18%. However, renewable generation offers the most competitive prices, followed by coal, gas- and diesel-powered generation, in our view. Although around 380 private energy generation companies are included in the “National Decarbonization Plan”, the bulk of energy production in Chile rests with the big four energy companies AES Andes, Colbun, Engie, and Enel – all of which are moving from coal to renewables. But the transition from fossil-based energy to renewable requires significant investments. For now, private companies have to address the financing of their transition into renewables on their own. It is estimated that the energy sector in Chile has USD 18 billion of projects under construction or under environmental review for future development. Companies expect to finance their investments with a combination of internal cash generation, equity, and debt. This offers new investment opportunities for debt investors. Large energy producers make up the bulk of the new debt issuance, but smaller players are also in the mix with companies like Inversiones Latin America Power tapping the debt capital markets for the first time in June with the issuance of USD 404 million to fund the construction of solar and wind farms. Investments also flow into the country’s transmission system as new lines need to be built, an example is the issuance in July of USD 1.2 billion by Interchile.

Currently as a net importer of energy, Chile aims to become an exporter of energy. To achieve this, it plans to triple its power energy from 77TWh in 2020 to over 220TWh by 2050, of which 94% is expected to be renewable. In the long run, Chile sees sustainability as a revenue generator for their economy; their goal is to turn green energy into greenbacks. Chile is not just giving lip service to sustainable goals, which is evident, over the recent years, in its legislative drive on the government side and the acceleration in green bond issuance on the corporate issuer side.

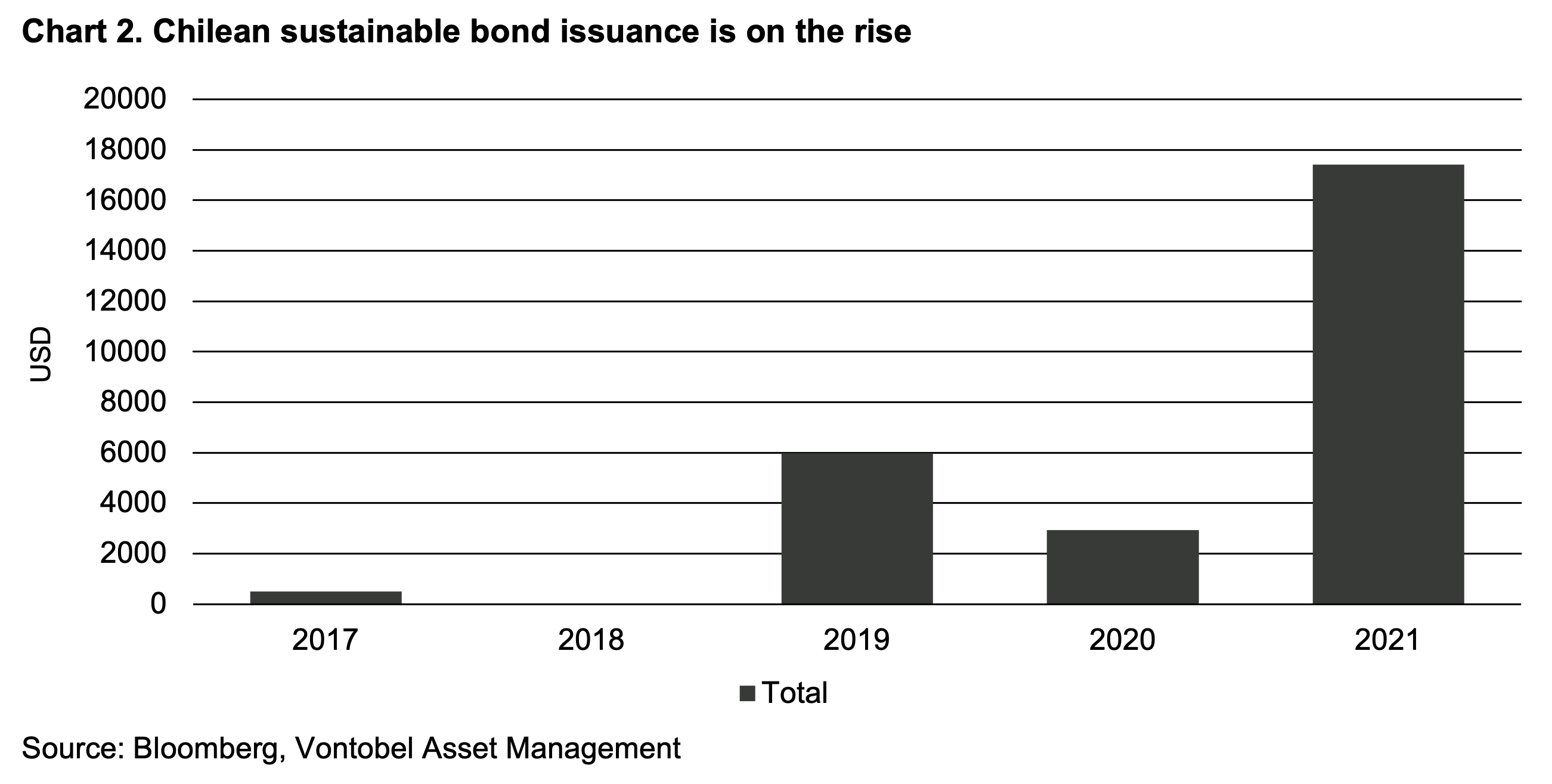

Chile has increased its labelled bond issuance from around USD 6.0billion in 2019to an estimated 17.4 billion in 2021 (see chart 2). This trend will continue in the years to come as new projects get approved by regulators. Also, sustainability developments in key industries such as mining and agriculture and even transportation will offer additional investment opportunities in the country. Investors are becoming ever more ESG aware and there is ample demand for sustainability-themed bonds. Chile is tapping into this demand to facilitate their goals.

Regulation drives sustainable progress in EM

Chile is uniquely gifted in renewable resources as highlighted in a recent paper by J.P. Morgan: “The deserts in the north of the country have the highest solar irradiance on the planet, the winds to the south blow endlessly with the same force as offshore winds”1

The growth in ESG investing is set to continue, spurred on by investor interest as they align their portfolios with sustainable goals. Developed market countries tend to be further along the path in sustainable operations with emerging markets playing catch up. Investors should see this as an investment opportunity as emerging market countries are in a position to make the biggest strides in reaching ESG goals while offering attractive spread premiums compared to developed markets. However, the emerging markets are a broad investment universe with countries differing in their commitment to sustainability. For EM corporate bond investors, the key is to identify those countries where the government and legislation is supportive and acts as a tailwind providing companies with an environment that supports sustainability. Chile is such an emerging economy and offers a clear roadmap, supported by the government and with companies taking real action to achieve sustainable goals. In combination, these act as a tailwind providing potential for growth and performance.

1 LatAm Hydrogen. Chile Leading the Revolution in LatAm, J.P.Morgan. Latin America Equity Research, 11 August 2021.

Wealth Management – actively managing your assets

You entrust us with the management of your assets, benefiting from our extensive investment expertise.

Legal notice

This publication was created by Bank Vontobel AG, Zurich (Vontobel). The document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. This publication is marketing material, is provided for information purposes only, and does not take into account individual needs, investment targets, or financial circumstances. The publication does not constitute an offer, a solicitation, or a recommendation to use the Vontobel service described in it, to purchase or sell securities or other financial instruments, or to take part in an investment strategy. Capital expenditures in financial products and markets pose various risks (e.g. market, currency, or liquidity risks). Before making an investment decision, investors should obtain personal advice from their financial and tax advisor concerning the risks associated with the investment and their personal situation. The content, scope, and prices of the services and products described in this publication are governed exclusively by the agreement concluded with the individual investor.

The information and/or documents offered on this website represent marketing material pursuant to Art. 68 of the Swiss FinSA and are provided for information purposes only. On request, further documents such as the basic information sheet or the prospectus are available free of charge whenever you wish. The products, services, information, and/or documents offered on this website may not be accessible to individuals domiciled in certain countries. Please note the applicable sales restrictions of the respective products or services.

© Vontobel Holding AG 2021. All rights reserved.