Climate change dominated the headlines for months – at any rate until the outbreak of Covid-19, when the direct threat to health pushed its ecological counterpart somewhat into the background.

Nonetheless, the general public has become more aware of environmental protection as a result of the months of climate-related strikes and demonstrations. Sustainability issues remain high on the political agenda. There is enormous pressure to conserve resources and operate on a more sustainable basis.

But how does it look in the financial sector? Have investors now embraced the idea? It is, after all, precisely through investment that ESG criteria (ESG = Environmental, Social and Governance) can be specifically taken into account in the investment policy.

How is the sustainable investment of money doing?

To answer these questions, Longitude, a Financial Times company, conducted a survey of 5,146 clients from 16 countries in August 2020 for the second time on behalf of Vontobel. The results provide some surprising insights – especially in comparison to the first survey, which was conducted in the spring of 2019, i.e. at the beginning of the global climate movement.

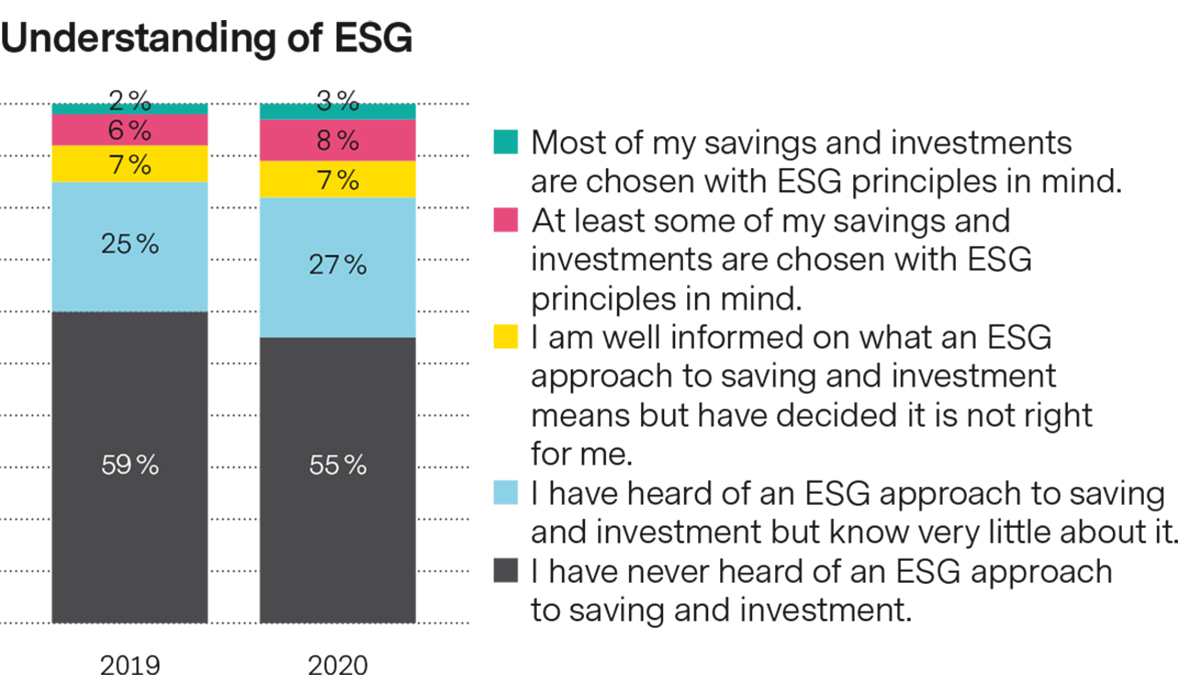

Around four-fifths of respondents are completely unaware that they can save and invest according to ESG criteria or although they have heard of it, they know hardly anything about it. The percentage has hardly changed since the last survey, even though the topic was omnipresent throughout this period:

Source: Longitude survey, August 2020

What is now common knowledge on the consumer side about how to live while minimizing the environmental impact (cutting back on consumption, using alternative forms of energy, etc.) has not yet been embraced by investors to the same extent.

Knowledge gap: an opportunity for bank advisors

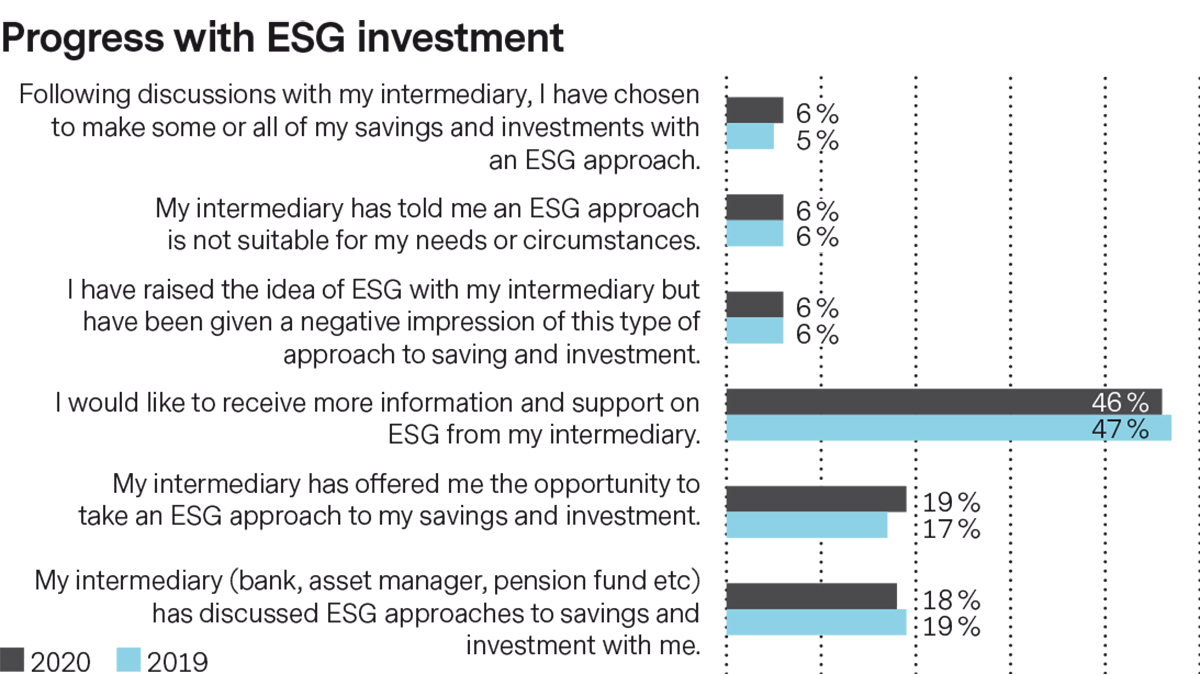

The survey also revealed that almost half of the respondents (46%) would like more information and advice from their bank advisors or financial intermediaries:

Source: Longitude survey, August 2020

This leads to the conclusion that there is a great deal of interest in the topic and that a lot of (investment) potential is lying idle. This is because clients either do not yet know that it is possible to make sustainable investments, or do not know how best to do so.

Sustainable = less yield?

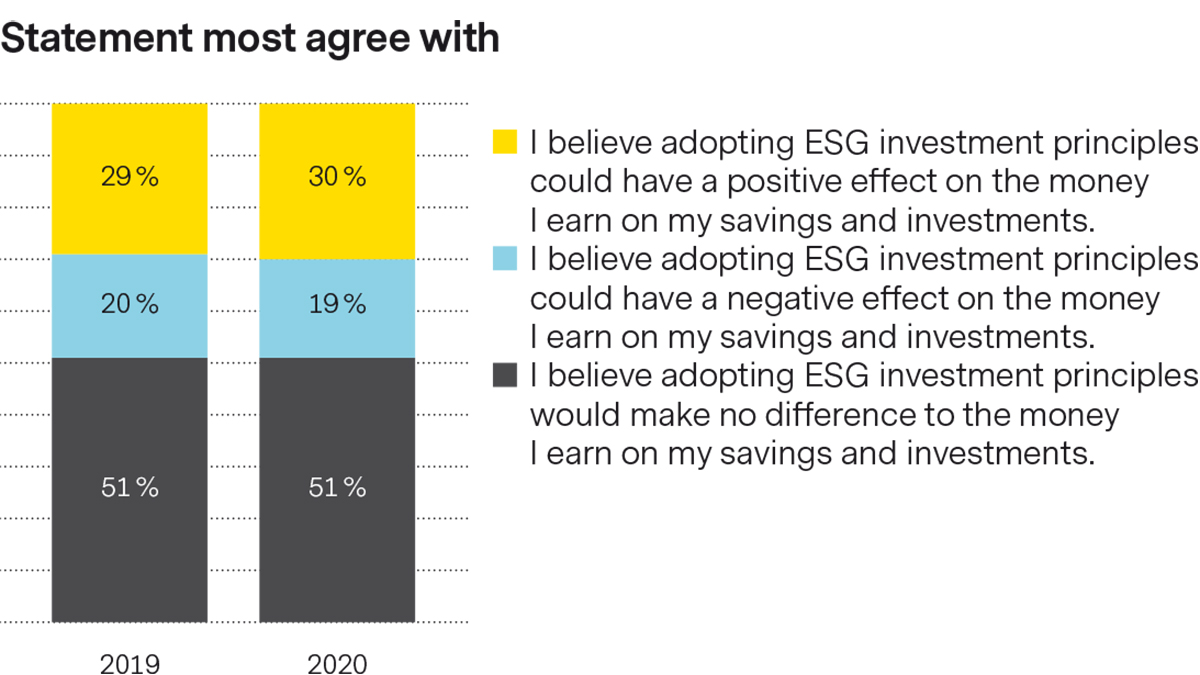

There is still a widely-held belief that sustainable investments are good for the environment and society, but that they are accompanied by lower returns. Around one-fifth believe that taking ESG criteria into account has a negative impact on investment income:

Source: Longitude survey, August 2020

Half of the respondents believe that ESG criteria have no impact on returns, even though an ESG filter on the portfolio could have a positive impact on the risk/return profile.

With regard to banks and financial intermediaries, some important conclusions can be drawn from this: there is huge interest in sustainable investment among investors, but due to lack of knowledge about it, they tend to be underinvested in ESG products. Financial advisors and service providers could meet this need and, with targeted advice and knowledge transfer, bring their clients closer to the world of investing in line with ESG criteria.

Read more insights on the topic of ESG (specifically for our visitors from Asia)