US midterms: What are the possible effects on the market?

The midterm election results showed that the Democrats are to take over the majority in the House of Representatives, while Republicans will increase their control of the Senate.

A split Congress means that President Trump will face more difficulty in advancing his agenda through the lawmakers. Such election results were widely expected, and the market reaction has been calm.

Infrastructure spending more or less likely?

Trump’s promise to increase infrastructure spending was not implemented so far. Amongst Democrats, there is a lot of sympathy for higher infrastructure spending. However, one could also argue, that Democrats will avoid everything, which president Trump could sell as a success of his administration. If Democrats in the House would follow this obstructive policy, higher infrastructure spending might be less likely after the Democratic House win, although because the two parties do not necessarily agree on which type of infrastructure should be financed.

Further tax cuts for middle income earners

Democrats would favor tax cuts for the lower- and middleincome classes. However, they would like to finance this by higher taxes for the rich. As Trump is not following the traditional Republican agenda, Trump may approve that approach.

Impeachment

We think impeachment is highly unlikely. Democrats could initiate impeachment after gaining the majority in the House. However, impeachment is decided in the Senate, which is still under the control of Republicans.

Trade policy

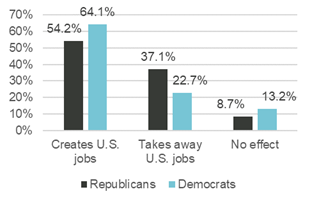

Concerning trade policies, the Trump administration can act widely independently from the Congress. Traditionally, Democrats, because of their connections with the trade unions, were more protectionist than Republicans. However, since Trump took over the Presidency, the opinion of Republicans and Democrats on trade have changed. A higher percentage of Democrats than Republicans in primaries believe that “trade creates U.S. jobs” and the reverse is true for “trade destroys U.S. jobs”.

Opinion on the effects of trade with other countries, by party primary

Source: The Primaries Project at Brookings

Concerning aggressive trade policy against China, both Republicans and Democrats support the view that China must open access to its markets and is using unfair investment practices. Therefore, we do not expect any change in Trump’s trade policy.

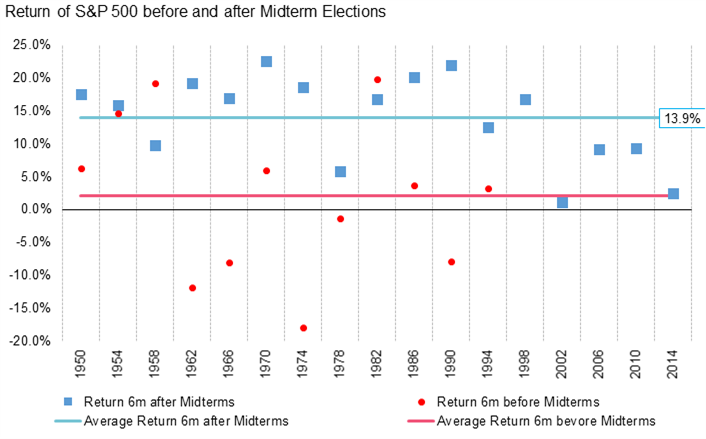

How equity markets have usually performed after the midterm elections

- If we look at the past and the last twelve years with midterm elections, we can see that the S&P 500 index was often at a difficult level six months before the elections, and only gained 2.1% on average. Some years were even strongly marked by a sell-off. However, if you look at the return six months after the elections, the average profit is 13.9%.

- The election result can usually have a negative impact on the markets in the short term, but often even develops into a positive driver beyond the end of the year.

- This year, we expect discussions about possible extensions of stimulation programs after the elections, which would help the market. With a divided government, the chance of tax cuts for households is minimized.

Source: Bloomberg, Vontobel