Preparing for a new world

Knowledge is power. Especially in investing. The world has been turned upside down in the last three years and is still grappling with the economic and geopolitical fallout from a pandemic and ongoing conflict in Europe. Understanding the flood of (mis-)information empowers investors to discover opportunities amid the chaos. What path are you charting?

Over the last few years, we’ve experienced firsthand the risks that a highly interconnected world brings.

The butterfly effect has been spotlighted like never before: A viral outbreak thought to have originated at a local food market brought the world to a standstill and catalyzed a massive, rapid and fundamental transformation in working conditions and infrastructure. Supply chains and financial markets didn’t escape unscathed either and, just when normality appeared to be slowly returning, geopolitical tensions have exacerbated turbulence and uncertainty.

The war in Ukraine began on the 24th of February, causing economic and political shockwaves and stirring geopolitical pots considered calmed with the end of the Cold War. Half a year later, the global economy is in upheaval and uncertainty remains. Investors are watching for signs of whether the world will tip into a recession. Consumers, grappling with surging prices across the board, continue to tighten their purse strings. And central banks are caught between a rock and a hard place: trying to smash inflation with increased borrowing costs, but in turn accepting economic pain that could linger for the foreseeable future.

In Europe, an intensifying energy crisis is rubbing salt in the wound as the continent scrambles to figure out alternative power supplies to Russia’s oil and gas. While this means that Europe will likely accelerate its efforts to achieve its net zero carbon targets, a scorching heat wave and water shortages mean that some countries are restarting old coal plants to address the energy crunch.

And though pressure on global supply chains appears to be easing, they remain in disarray and are poised to keep trade slowed down while nations and companies alike adjust their supply chain concepts, especially as demand weakens. That’s something China, sometimes referred to as 'the world’s factory', has already started to feel. Even so, the Chinese economy is starting to reopen from stringent zero-Covid restrictions.

Operating against this backdrop, it can be hard for investors to know how to act. Is it the right time to invest? Is it the right time for an exit? Or is it time to swap to another asset class? During challenging times, these questions are at risk of being answered by emotions, especially as conflicting information circulates, and investor confidence has taken a hit. It takes skill and broad-based understanding to invest in such an environment.

“The current market phase is particularly uncertain and prone to volatility,” says Christel Rendu du Lint, Vontobel’s deputy head of investments. “The ability to invest in such times is the ability to correctly decipher these phases. Right now, we are dealing with a unique combination of events – the individual and societal impact of a global pandemic, the heightened geopolitical tensions and for the first time in decades a truly inflationary environment. I am a firm believer in making quality investing accessible to all – and this entails making the influencing dynamics understandable for everyone, no matter how complex or unprecedented.”

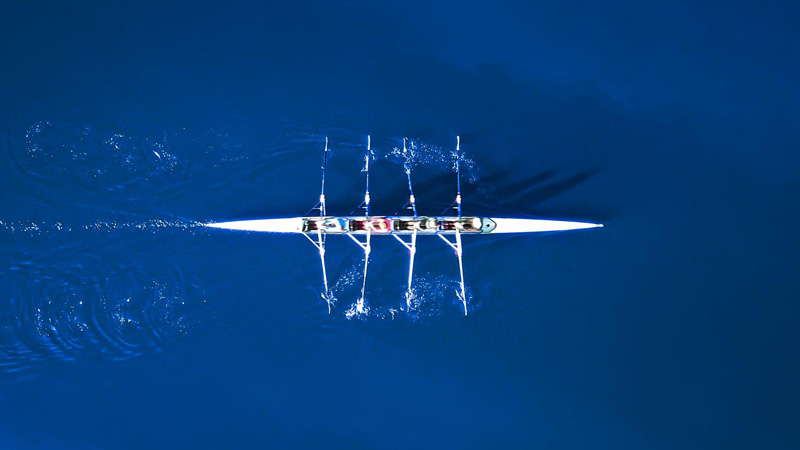

At Vontobel, more than 300 investment professionals team up with one main goal: empowering investors to build better futures.

We know each and every one of our clients has different needs. We believe we can meet those needs with our multi-boutique approach, which includes expertise ranging from equities, fixed income and multi-asset, and offers highly individualized solutions for investors. Mixed with Vontobel’s performance culture and canny risk awareness, our clients can trust us to explore individual options for their assets.

“As an economist it’s always key to consider how people will react to current events happening around the globe”

says Reto Cueni,

Vontobel’s chief economist.

“As an economist it’s always key to consider how people will react to current events happening around the globe” says Reto Cueni, Vontobel’s chief economist. “The past couple of years have seen a lot of shockwaves hit both companies and households. People have had to react and adjust at a very fast pace. Take supply chain issues during the pandemic, for example. Supply chain disruptions meant delays, so many firms and households attempted to stockpile goods to circumvent potential future disruptions, and the outcome was that supply chain disruptions got even more severe and prices rose even higher.”

“This year, with the war in Ukraine, we’ve seen further shocks to the system. Crucial energy supplies are compromised, energy prices jumped and the question is how people will adapt their behavior now. As investors, we shouldn't lose sight of the big picture despite all these rapid changes – to that end, at Vontobel, we analyze not only short-term changes, but also long-term trends and make them visible to our clients.”

This means, no matter how many headlines investors have to digest every day, we can help focus on the information they need to get ahead.

Here are a few key things to consider:

One of the main reasons the global economy is in its predicament is the war in Ukraine. The biggest conflict in Europe since World War II will keep the continent on its toes, as a prolonged war will further significantly impact crucial commodities, ranging from wheat to oil and gas. The energy crisis raises the risk of the region slipping into a recession, and question marks remain around the longer-term consequences of the corporate exodus out of Russia, as well as the western sanctions against Russia. China is also observing the situation closely for lessons on any risks that come with escalation in Asia.

⇨ At Vontobel, we are systematically sifting through the news and breaking down the events going on, together with external experts and our investment specialists. We are analyzing the consequences of these events on the capital markets and drawing investing conclusions for our clients.

Many investors are anxious. The war in Ukraine has contributed to the worst inflation in more than four decades, exacerbating price increases resulting from pent-up demand during the pandemic that led to lingering supply shortages. And it’s being felt everywhere. Central bankers from around the world have signaled they’re committed to fighting inflation, even if it means the economy will go through an extended period of pain, including slower growth and a weak labor market. Higher inflation is expected to linger for years to come. That means that savers might be at risk of being the biggest losers.

⇨ A Vontobel analysis that compared yields of different asset classes during times of rising inflation since 1973 showed that equities and commodities outperformed when inflation was low, but rising. When inflation was rising at a high rate, commodities and gold were safe assets. And in the case of inflation exceeding 6%, gold seemed to be the only place of shelter.

So, what does this all mean? Taking a long-term approach can protect investors’ assets. As inflation rages, yields in capital markets are a much-needed key ingredient to get the most return for your money. You don’t want the value of your money to be eroded by inflation over time. If you feel like you don’t want to take the risk, remember that not all investment risk is equal. Therefore, personalized strategies that work with individual timelines, goals and risk thresholds are increasingly important. It’s a new and rapidly changing world, and investors can adjust to it with a diversified portfolio.

⇨ For more insights on different investing options, ranging from equities to fixed income and multi-asset,

visit https://am.vontobel.com/en