A Global Recession? Think Twice

Central banks are prepared to do what it takes to smash inflation, raising concern over whether their measures will tip us into a global recession.

En savoir plus

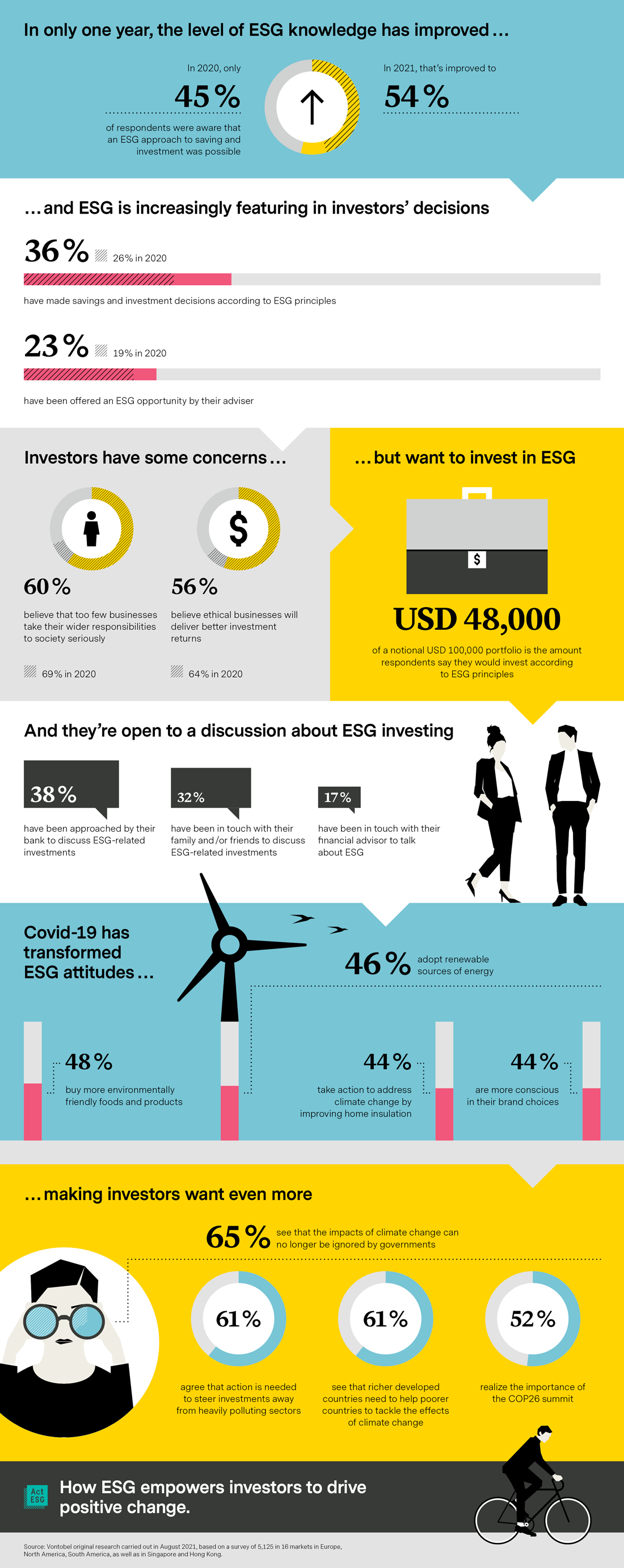

Act ESG: Your conviction needs an investment strategy

A historic shift of assets is emerging. Take the lead, with us, in this transformation.

ESG investing takes into account fundamental concepts related to sustainability as well as aspects specifically relevant for investors. As established guidelines used to evaluate investments taking a forward-looking view, ESG criteria have proven themselves, both from a risk perspective and in terms of return expectations – valid for investments emanating from the G7 to the emerging markets.

Companies with good ESG ratings are more than just a “goodwill” investment today. Our experience has shown that ESG products perform on a par with comparable indices. In addition, they are a proven tool for including even long-term risks in investment decisions.

When it comes to ESG, many of your clients are most likely grappling with a not insignificant knowledge gap. This is exactly what gives you the unique opportunity to position yourself with ESG expertise ahead of your competition.

“ESG monitoring has also developed into a tool for checking return expectations.” |

The reason: Investors who evaluate potential investments according to ESG criteria take into account not only economic considerations, but also how well (or badly) a company is managed, or how its actions are affecting society and the environment. This directs their attention to developments that will have a lasting impact – and thus also to developments that have the potential to generate long-term returns.

Actively managed certificates (AMC) are a new generation of structured products that can be actively managed – for example in line with an ESG strategy.

ESG at investerest

Our experts are happy to discuss with you, without obligation, how ESG investments can become a success story for you. Contact our Product and Governance team:

Learn more about ESG in the context of Vontobel Asset Management.

*for professional investors

Anyone who issues structured products and AMCs, like Vontobel does, must be able to demonstrate especially clearly to investors that they are a reliable partner. That is why we are particularly proud that one of the leading ESG research and rating agencies, the ISS Group, has awarded Vontobel “Prime Status”.

This recognition is not only positive news for you in terms of issuer risk, it also confirms Vontobel’s above-average sustainability performance. For us, it goes hand-in-hand with a reliable capital base and the forward-looking entrepreneurial thinking of a company that has been majority-owned by its founding family for decades.

Thanks to Vontobel, since May 2019 investors have been able to buy certificates whose underlying assets have been subjected to a sustainability analysis.

Since 2010, Vontobel has been a signatory to the UN initiative “Principles for Responsible Investing” (PRI). In 2020, our sustainable investment strategies again received an above-average PRI rating.

Find out how we work to develop funds that are in demand in ESG investing, and browse our ESG library for regional markets.

Central banks are prepared to do what it takes to smash inflation, raising concern over whether their measures will tip us into a global recession.

En savoir plus

|

|

As a globally operating investment firm, we are aware that we have a responsibility to our stakeholders to play an active role in the sustainable transformation of our economy and society for future generations. More than 25 years after launching our first sustainable investment solution, we still take the initiative to speak with you about the challenges ahead, but also to show you how this historic transformation process is creating unique opportunities for you as investors.

|

Everything starts with a personal conversation. We would be happy to explain to you how ESG investments can become a success story for you.

Your contact at P&S Products and Governance: pspg@vontobel.com

pspg@vontobel.com

|

|

What do you believe in?“Act ESG” is our signal to you – and our invitation to invest sustainably. If you are interested in taking advantage of our range of sustainable investments, just look for this symbol. “Act ESG” enables us to help you make informed and active decisions, so that you can blaze a trail that best suits your convictions. |