Investing in times of inflation

Thoughts on portfolio alignment during rising or declining inflation

Inflation can significantly impact investors. Now that we have laid the supposed “specter” to rest, this blog article will forge a link to the financial markets. How should investors be positioned in times of inflation? Find out which price index economists use to measure inflation and which asset classes and sectors have performed best in the past in an inflationary environment.

Economists differentiate between “headline inflation” and “core inflation”. Headline inflation includes

expenditures for volatile items such as food and energy. Core inflation, on the other hand, omits these short-term influences, and is viewed as an indicator of underlying long-term inflation.

In addition to differentiating between headline inflation and core inflation, investment experts also take into consideration differing types of price index when evaluating the effects of inflation. Here a comparison of the three most important ones—these are particularly relevant in the context of the US economy:

© Vontobel 2022. Source: Refinitiv Datastream, Vontobel.

How should portfolios be aligned?

In addition to actual inflation rates, investors are mainly interested in how their own portfolio can be optimized in times of rising or falling inflation. While past performance is no guarantee for future returns, we still think it makes sense to compare past trends for different asset classes and sectors.

For this purpose, we differentiate between three degrees* of inflation:

- Periods of low inflation. We consider these to be times in which price rises in the USA are below three percent.

- Periods of high inflation. Price rises in the USA are between three and six percent.

- Periods of very high inflation. US price growth is over six percent.

* In order to distinguish uniformly between inflation degrees in all markets, we classify them in accordance with US inflation. Calculation of yields below is based on global financial market data.

Yields in Comparison: Performance since 1973

The following charts allow you to compare inflation effects in an environment of low, high and extreme inflation one after the other in the slider.

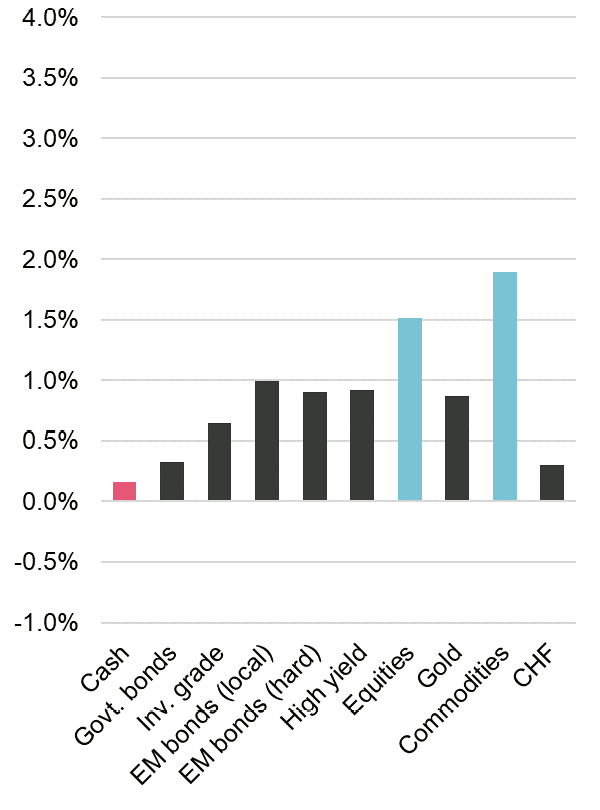

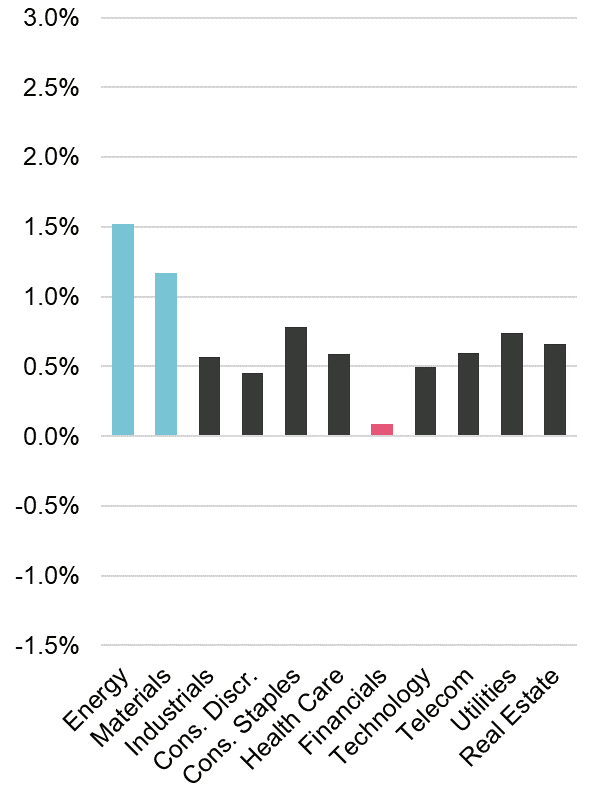

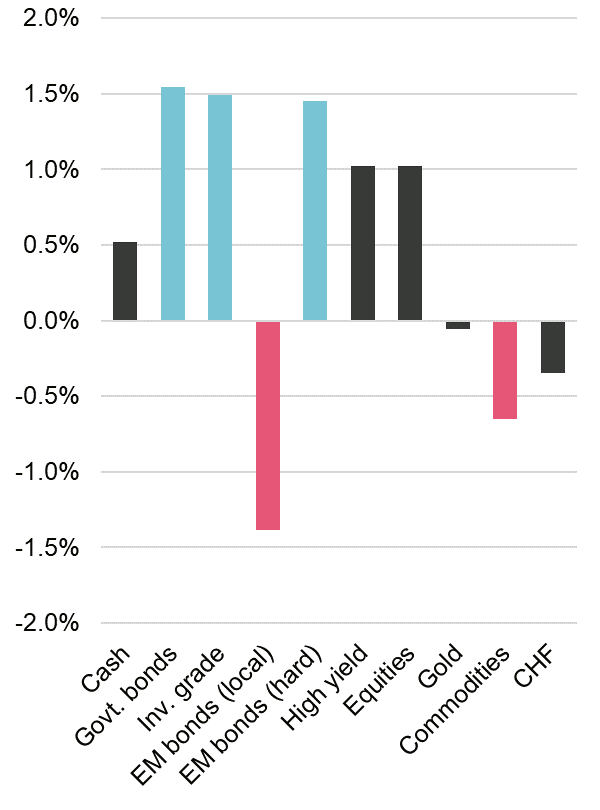

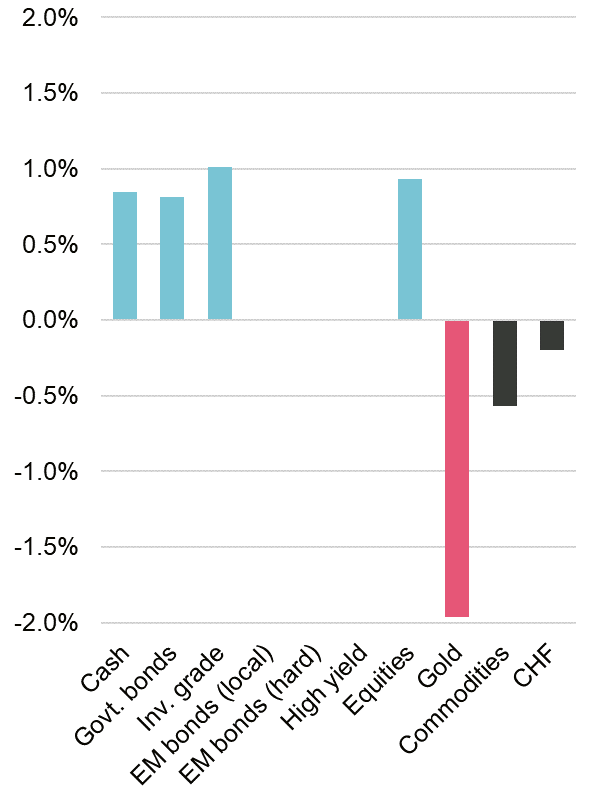

Rising inflation: asset class returns

During times of rising, but low inflation, equities and commodities were the place to be, while cash was the least attractive option.

During times of rising, high inflation, investors have historically been well-advised to invest in commodities

and gold, but also equities posted positive returns.

Lastly, the analysis suggests that gold seems to be the only place of shelter when inflation is spiraling

out of control (i.e., above 6 percent), while equities and longer duration bonds generated negative returns.

Source: Global Financial Data, Refinitiv Datastream, Vontobel.

Note: no data is available for EM local and hard currency bonds as well as high yield bonds during times of rising, very high inflation.

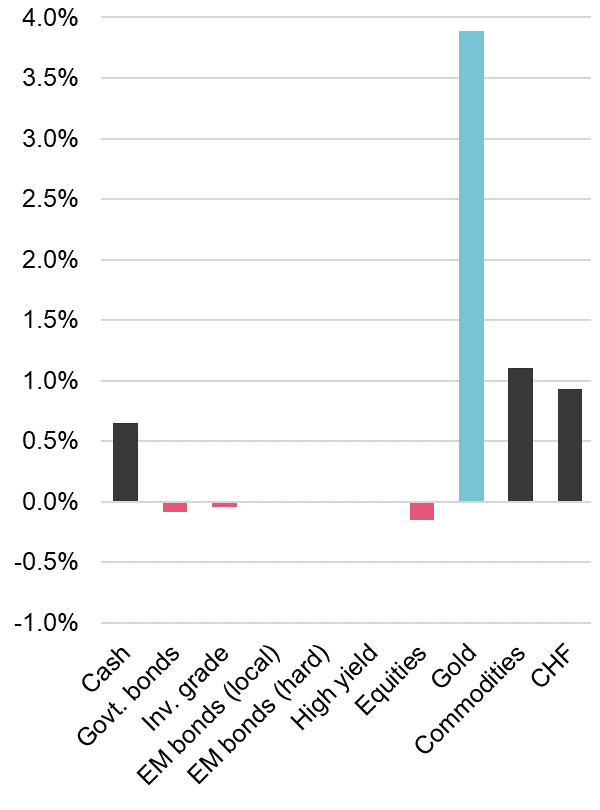

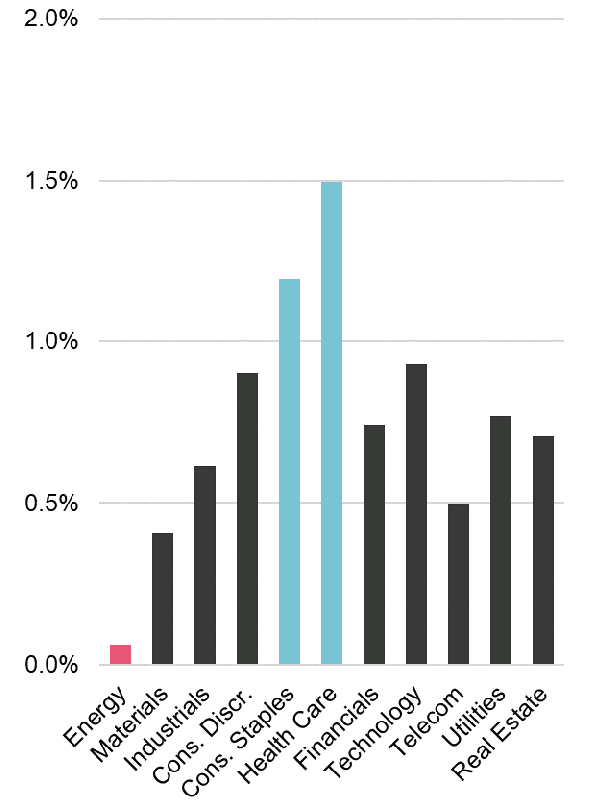

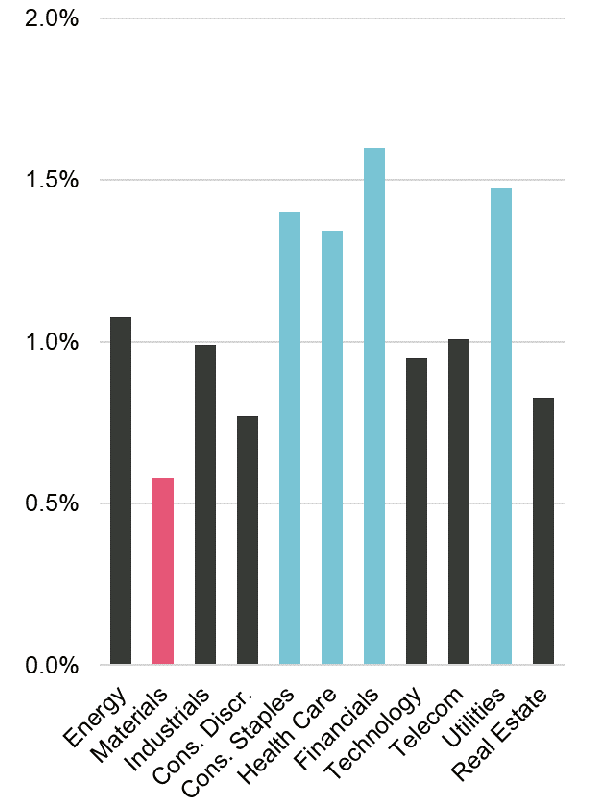

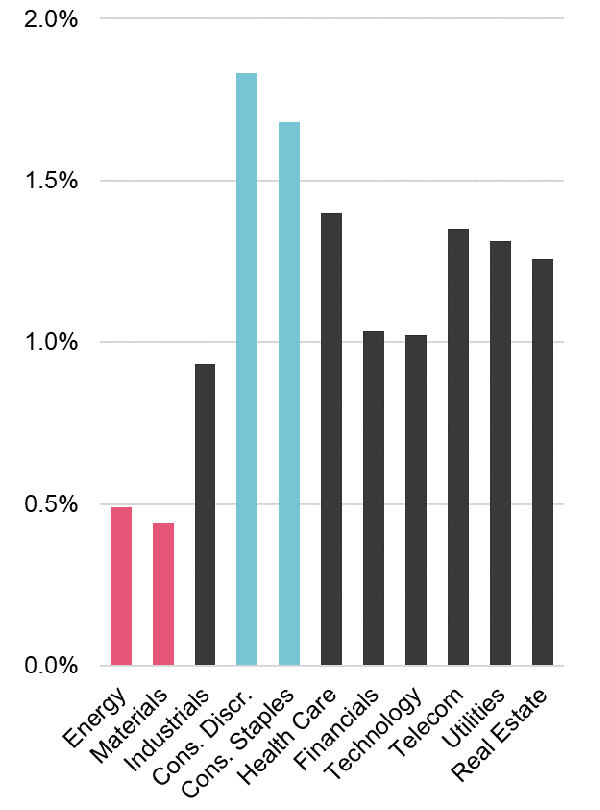

Asset classes and sectors during rising inflation

During periods of low inflation, tech managed to notch the highest returns while defensive sectors (consumer staples, health care, utilities) fared worst.

In a rising, high inflation environment, commodity sectors performed best and financials worst.

Commodity-related sectors also had the upper hand when inflation surged above 6 percent, while consumer-related sectors and tech were the least attractive.

Source: Refinitiv Datastream, Vontobel.

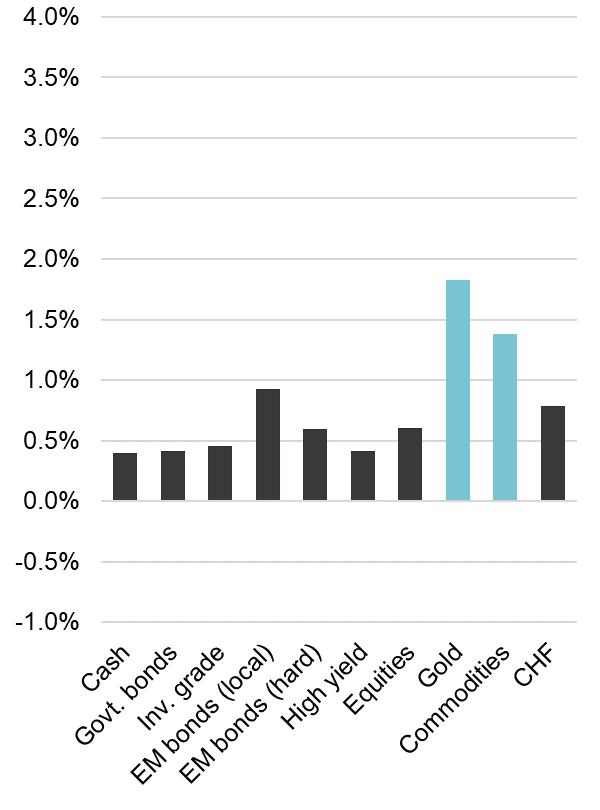

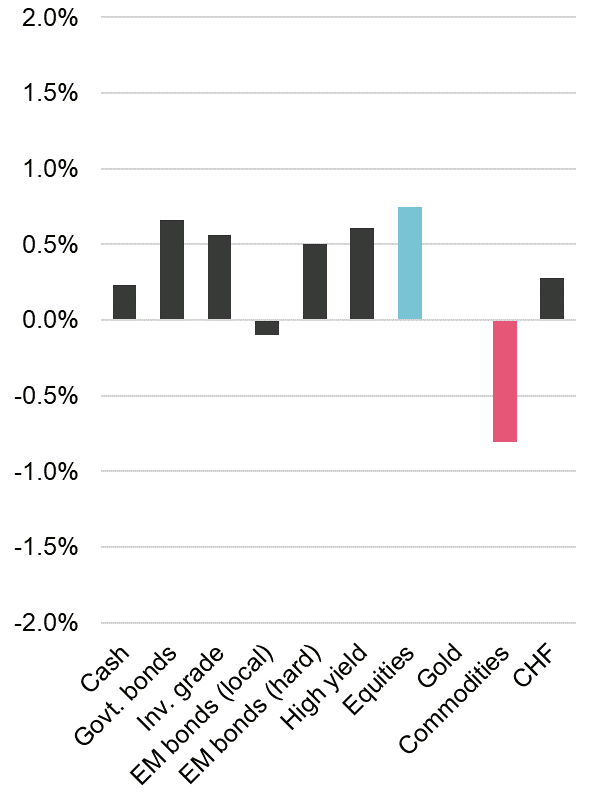

Falling inflation: asset class returns

The chart demonstrates that in a low inflation environment, equities have performed best and commodities worst.

In a high inflation environment, assets with a long duration were best and commodities as well as emerging markets bonds in local currency worst.

In an environment in which prices came down from very high levels, cash, bonds, and equities fared best while investors were well-advised to stay away from gold.

Source: Global Financial Data, Refinitiv Datastream, Vontobel.

Note: no data is available for EM local and hard currency bonds as well as high yield bonds during times of rising, very high inflation.

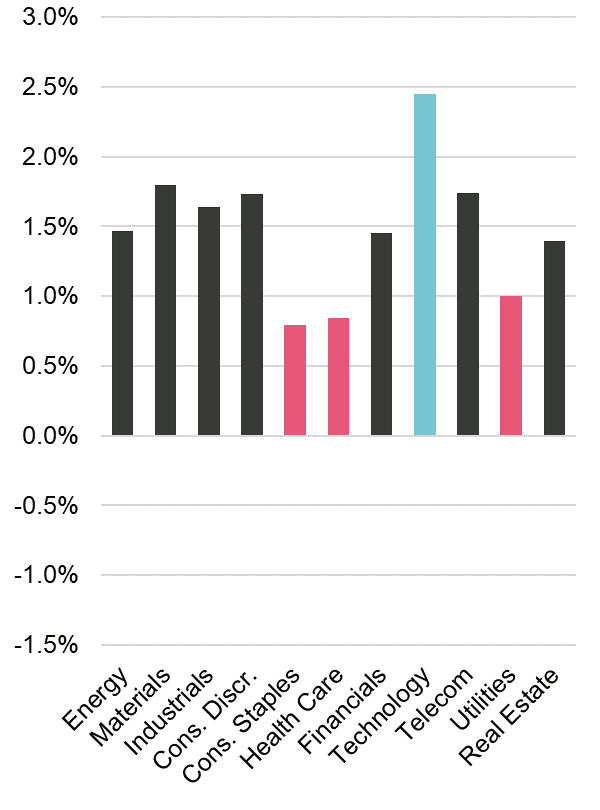

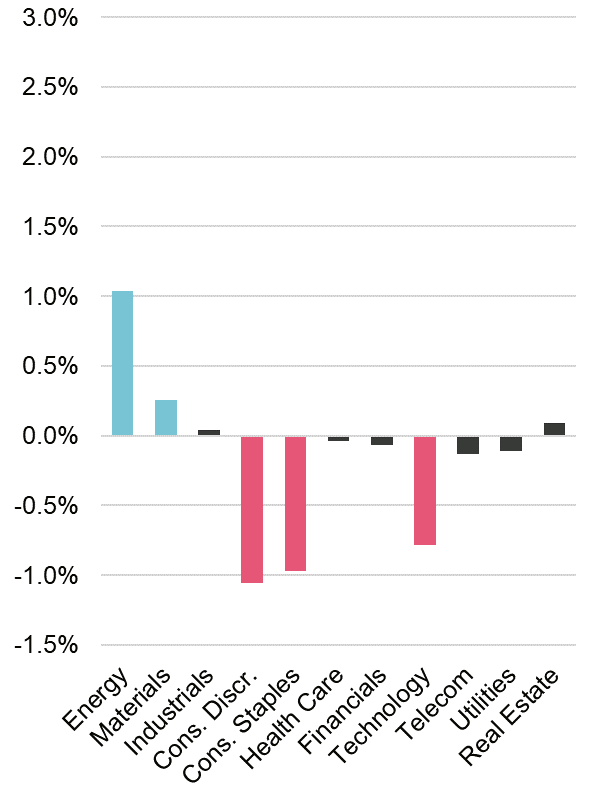

Falling inflation: sectors with yields

Health care and consumer staples performed best during times of falling and low inflation while energy struggled but was still positive.

Periods of high, but falling inflation benefited defensives and financials the most and materials the least.

Periods of very high, but falling inflation bode very well for consumer-related sectors and not so well for commodity-related ones (see the chart below).

Source: Refinitiv Datastream, Vontobel.

Fazit: Key takeaways for investors

The five most important points in times of rising inflation:

1.

Inflation can be a game-changer, especially when it is very high (i.e., exceeding six percent).

2.

Commodities have historically lived up to their reputation as inflation hedges. While the asset class under-performs in normal times, it performs most reliably during times of rising inflation.

3.

Our analysis shows that gold remains the best tail hedge for investors if inflation goes through the roof.

4.

Our study also suggests that investors should not necessarily shy away from equities during times of rising prices: equities have mostly been able to withstand price pressure, even during periods of rising and high inflation. Our analysis indicates that the only time when exposure to stocks should have been reduced is when inflation was running out of check.

5.

While equities do mostly well, a selective approach that fits with the inflation outlook is still key. This is especially true when looking at it from a sector perspective.

The five most important points in times of falling inflation:

1.

Markets seem to like such an environment – historically, most asset classes performed well, including cash, bonds, and equities.

2.

The level of inflation seems to be less relevant when inflation falls than when it rises (in our analysis, bonds and equities performed only slightly better when inflation was falling, but above three percent).

3.

Not very surprisingly, commodities tend to suffer when inflation comes down. The same is true for other inflation hedges, such as gold.

4.

History has shown that the Swiss Franc has been depreciating versus the US-dollar in times of high but falling inflation – it is therefore not the place to be in such an environment.

5.

In times of falling inflation investors should be selective with equities. Defensive sectors have historically outperformed during times of declining inflation. Also, financials have fared well, while commodity-related sectors should have been avoided.

Anche da leggere in questo contesto

Winners and losers in an inflationary environment

Who suffers the most when prices are rising? First and foremost, the savers – because higher prices lower the real value of their savings.

Employees who are tied to fixed-wage contracts are also impacted, as are credit allocators such as banks who have fixed interest-rate returns on the money they have loaned. Then there are the importers whose goods typically become more expensive when their domestic currency loses value against currencies with lower rates of inflation.

Others, though, profit from higher prices: as a rule, anyone with debts at a nominal fixed interest rate, such as indebted governments, companies and private households.

Companies with high levels of debt typically also benefit. Often, an inflationary environment makes it possible for them to pass on higher production prices to consumers. The “additional money” which is generated can be used to service existing debt.

In addition, private individuals who have invested in so-called inflation hedging (material assets such as real estate, commodities or gold) also benefit when the value of their investments increases.