What you told us

How are you approaching investing right now? During these turbulent times, we asked our community what’s on their minds.

Investing is the new saving. That rings true even when markets are roiling. But when uncertainty prevails over an extended period of time, deciding what to do next can feel tricky and cause anxiety. Some investors may clam up and freeze in times of market turbulence, or at least wait it out on the sidelines, while others may want to pull out all together.

We’re dealing with a unique combination of events right now – a pandemic, the invasion of Ukraine and the return of a highly inflationary environment for the first time in decades. Given these circumstances, we wanted to get direct insight into how our community is reacting. How are investors approaching investing during these turbulent times?

Key takeaways

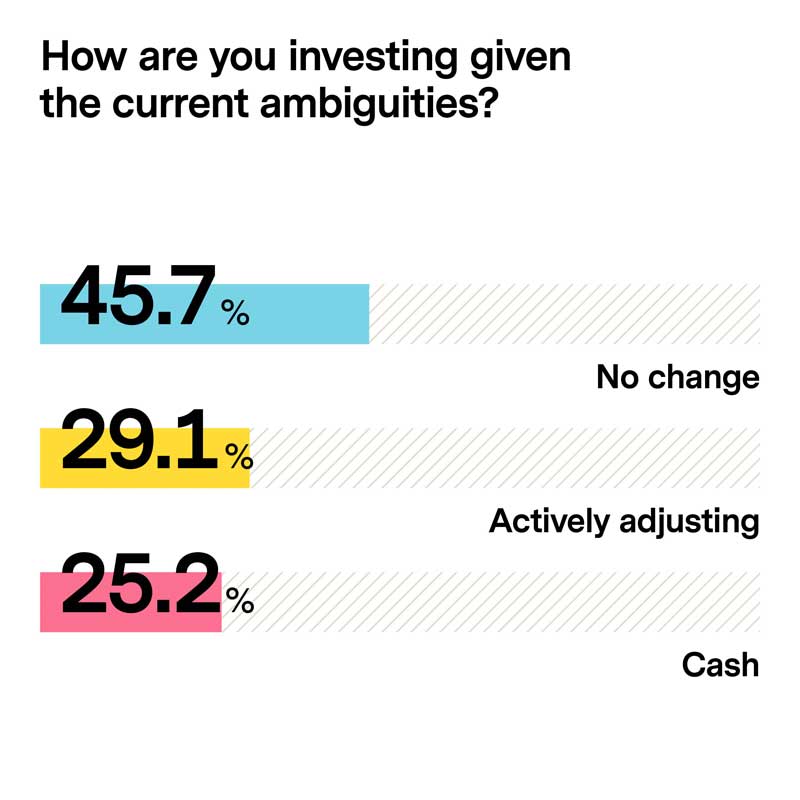

A hands-off approach

Nearly half of investors reported no change, showing the current market environment didn’t move them to buy or sell. That neutral stance reflects a hands-off approach – hoping for the best while riding out the storm. But with so many things in the world changing, it may well be time to reconsider, as just under a third of respondents did. If this is where you find yourself, we can help. We aim to empower you in diversifying portfolios and spreading investments across asset classes and sectors in the best possible way to cushion potential risk exposure. Many reported going to cash. This can be attractive if funds are required for immediate or short-term needs, yet it’s a move that could mean missing out on gains to be made from market rebounds.

Source: Surveyed 2,989 global potential private and institutional investors. Survey period: July 20 to August 3, 2022

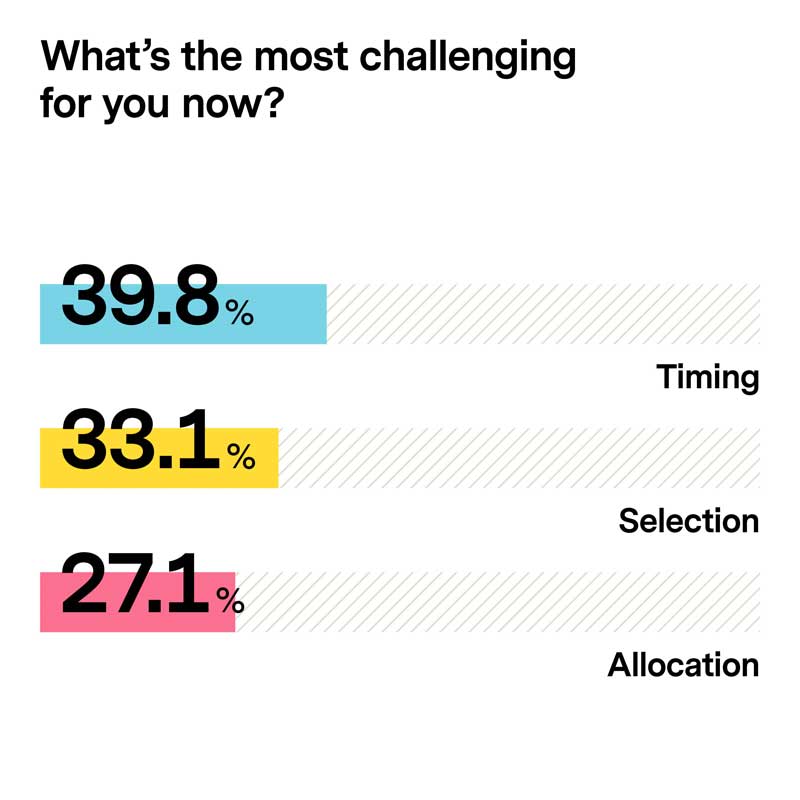

Source: Surveyed 2,989 global potential private and institutional investors. Survey period: July 20 to August 3, 2022

Timing is everything

The majority of survey respondents pointed to timing as their biggest challenge. A third of investors said they were struggling with selection, followed by more than a quarter grappling with allocation decisions. It can be tempting to try and predict what markets will do, and many believe that regular and consistent investments over time results in higher returns than attempting to find perfect timing, which comes with the risk of opportunity costs. With it nearly impossible to time the market, is taking a long-term view with strategic asset allocation and fund selections the path of least resistance to yield returns?

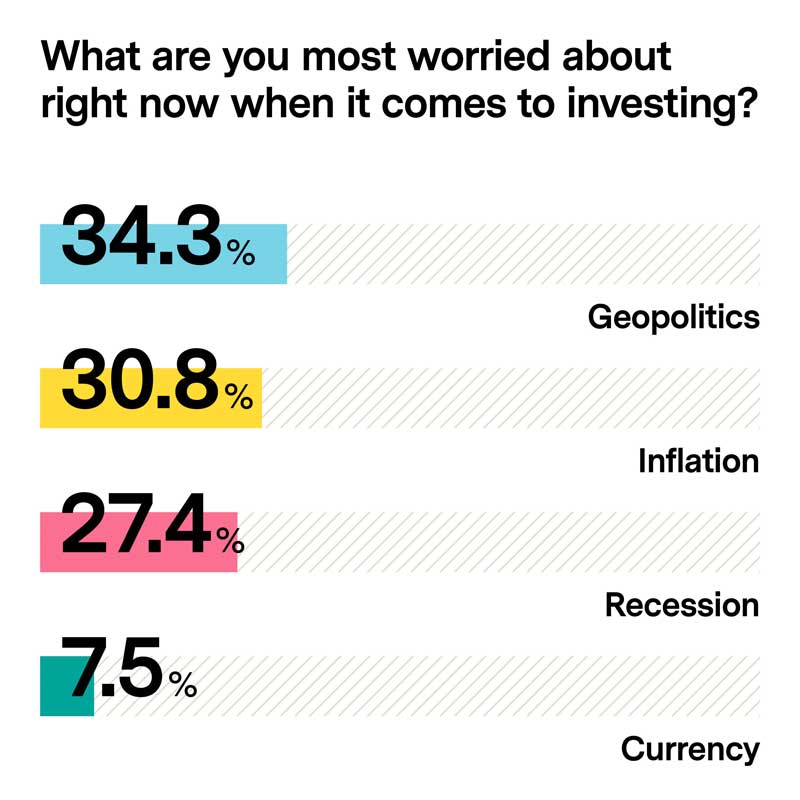

Geopolitical risk

Among all the different threats to the economy making headlines, geopolitics stood out as top of mind for investors. This is hardly surprising, given the increasingly fragmented and polarizing world we occupy. A close second was inflation, followed by recession. The lowest ranking concern was currency risks. Looked at independently, each of these factors requires skilled assessment when assembling investment portfolios. When such factors hit at the same time, a new layer of complexity is added. At Vontobel, we analyze these dynamics day in and day out, assessing both their short- and long-term impacts – essential information when it comes to making tough decisions during challenging times.

Source: Surveyed 2,989 global potential private and institutional investors. Survey period: July 20 to August 3, 2022