Disruptors Going Public

Many of the tech world’s legends begin with three little letters: IPO. Initial public offerings have been capturing investors’ imagination since the early years of the internet economy. Unfortunately, many dotcom stock valuations proved to be equally imaginary. Today, digital technology has acquired greater significance and become an integral part of our everyday lives.

Today’s IPOs are on much more solid ground. In 2019, some of the most important and successful disruptors in recent memory will be going public. Their valuations will depend less on factories and other conventional assets and more on their platform, business model or growing customer base.

Investing in a new business model

All these companies are built on a realization that current industries are inefficient in some way. They can harness the internet’s advantages – network effects and scalability – to capitalize on these inefficiencies. They can quickly and cost-effectively roll out their business model to new markets without significant capital expenditure, whilst also turning these markets on their heads. That’s how Uber disrupted local transportation markets around the world, while Airbnb has skyrocketed to the leader of the hospitality industry.

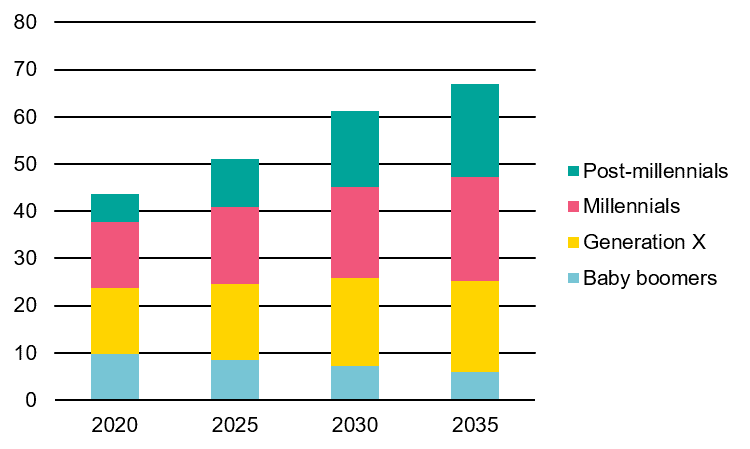

The upcoming IPOs allow investors to participate in these growth stories. Like all investment decisions, this requires an assessment of the future. We will take a close look at these IPOs when they appear. However, we have no doubt that tech’s disruptive potential is far from exhausted. Disruptors’ services are largely used by millennials, who will play an outside role in driving consumption growth as their incomes rise significantly in the years to come.

Income by generation in the US (in USD trillions)

Source: White House Council of Economic Advisors, Vontobel

Risks of investing in financial markets

Investing in financial markets involves risks. The price, value and return of an investment depend, among other things, on macroeconomic trends and the prices of the underlying securities.