Pillar 3a: What you need to know about your private pension plan

Answers to the most important – and most frequently asked – 3a questions

Private pension plans are becoming increasingly important in Switzerland – which is why it can be even more worthwhile to pay the maximum amount into Pillar 3a every year. However, two issues matter here: first, whether your pension assets are being invested, and second, how you would like to withdraw from Pillar 3a later. The earlier and more comprehensively you can make such plans for your pension, the more options you will have.

Providing for your retirement is an important topic in Switzerland. Many people will be dependent on their Pillar 3a (private pension plan) to be able to maintain the standard of living they are accustomed to after retirement. But how does it work, and what is the best way to benefit from its advantages? Find out the basics directly from our financial planners.

Who can pay into their Pillar 3a accounts?

In principle, anyone can pay into Pillar 3a who is earning an income subject to AHV contributions. For example:

- Salaried employees

- Self-employed persons

- Persons receiving unemployment benefits

- Cross-border commuters

- and also people from abroad who are resident in Switzerland

You can contribute beginning at the age of 18, right up to retirement age – or even up to five years after reaching this age if you continue to work after retirement.

People whose income is derived from rent, interest, or dividends are not entitled to pay into their Pillar 3a.

What is the advantage of paying into Pillar 3a?

If you pay into Pillar 3a, you can save taxes – sometimes more than 40 percent of the amount paid in, depending on your income level and where you live. This is because all these payments, up to the maximum amount allowed, can be deducted from your taxable income.

What is the Pillar 3a maximum contribution that can be paid in?

- CHF 7,056 for persons who are affiliated with a pension fund

- CHF 35,280 for persons without a pension fund (e.g. self-employed persons who own a sole proprietorship), but no more than 20 percent of their earned income

Securities in Pillar 3a: Yes or no?

In Pillar 3a, you can choose between a regular account solution and funds holding shares of various equities (up to 100 percent). In principle, with a long investment horizon, the securities option should promise a higher return – but it is associated with greater risk, of course.

In any case it is best not to regard your Pillar 3a in isolation, but within the context of your overall asset situation, i.e. to consider it together with your freely investable assets, which you can also use to accumulate capital. An example:

-

If you hold shares as free assets, any capital gains you make (i.e. profits due to the shares increasing in price) are tax-free.

-

If you hold shares in your 3a portfolio, the capital gains are also tax-free. As soon as you pay out your 3a portfolio to yourself, however, capital gains tax is due on the invested amount and the profit.

-

This is why it can make sense to pursue return targets where taxes are lower, namely with your free assets. Then, to balance out this higher risk, place lower-yielding asset classes such as bonds in your pension account.

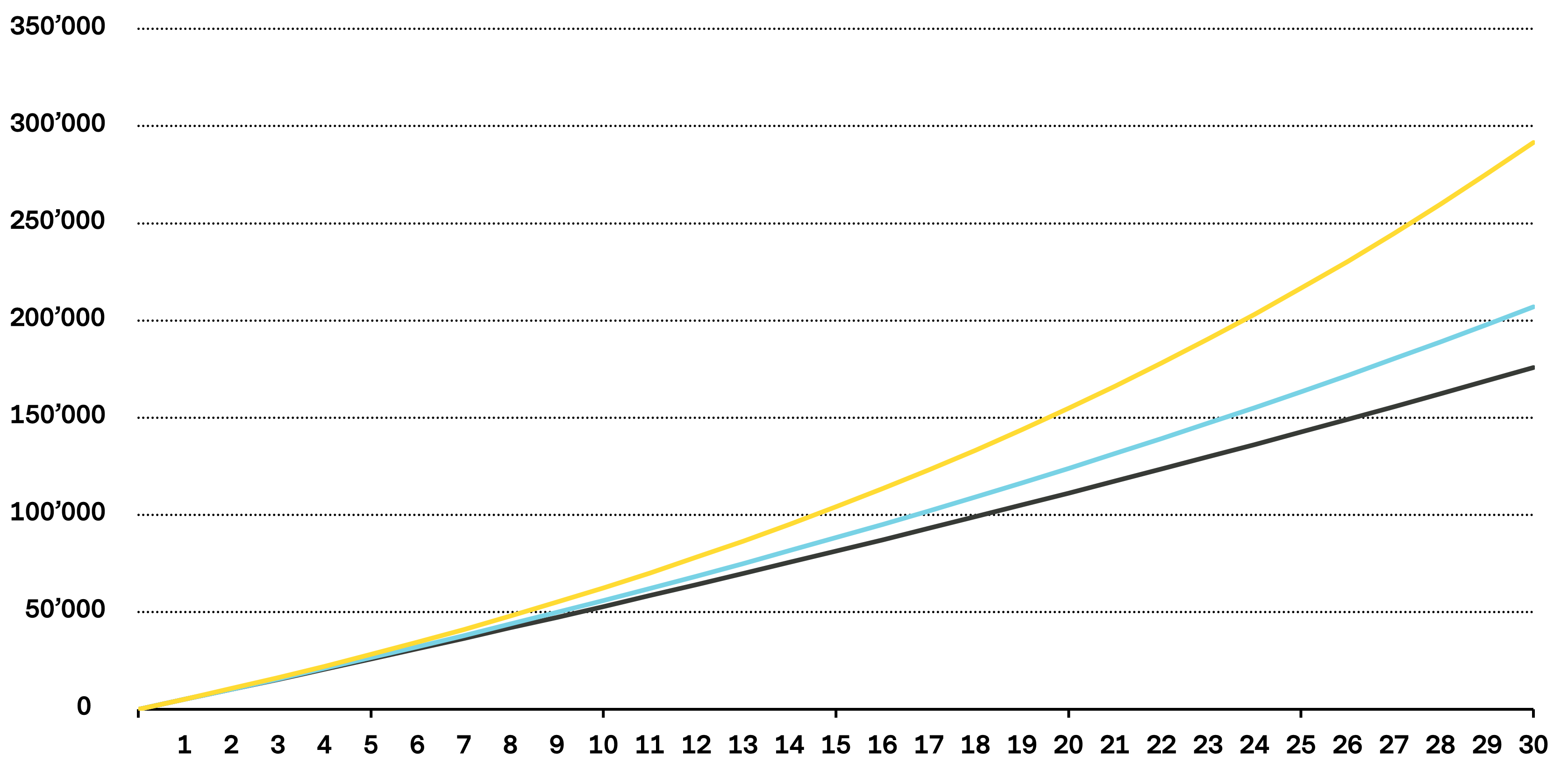

Asset growth resulting from different returns (in CHF over 30 years)

Source: Vontobel

▬ 0% return ▬ 2% return ▬ 4% return

Comparison: This chart shows the projected growth of a portfolio based on annual payments into the account of CHF 5,000, but with different interest rates applied (and compounded at the same rate). The calculation is for purposes of illustration only and does not take into consideration any fees or costs that may be incurred when buying or selling shares.

When and how can I make withdrawals from my Pillar 3a?

In principle, you can withdraw money from your Pillar 3a as soon as you have reached normal retirement age. However, you already have the flexibility to withdraw 3a funds up to five years earlier, or five years later. This flexibility is being maintained in the “AHV 21 reform of the AHV system”.

As soon as you withdraw your capital, you must pay tax on your 3a assets at the tax rate in effect for pension assets.

However, there are certain exceptions to withdrawing Pillar 3a without retiring:

- if you are buying residential property,

- if you become self-employed, or

- if you move your place of residence abroad.

Important: If you intend to take one of these steps, be sure to include your pension funds in your planning at an early stage.

Does a second 3a account make sense? And a third?

First of all, note that you can open as many 3a accounts as you like. The reason why multiple accounts are worthwhile in most cases is the progressive tax rate applied when withdrawing from them later. From any given account, you can only withdraw the entire amount as a retirement fund – you cannot withdraw from it in stages.

Take this specific example of a married person in the canton of Bern:

- If you withdraw CHF 200,000 from one account in a single withdrawal, you will pay taxes of CHF 11,204.

- If you withdraw CHF 50,000 from four different accounts, you will benefit from the progressive tax rates, paying a total of only CHF 6,108 in taxes. In other words, your tax obligation is reduced by almost half.

It therefore makes more sense to tap into your Pillar 3a savings by doing so across different accounts in multiple stages and coordinating this with your pension fund. As always, the time-honored rule applies here: The earlier you plan, the better you can coordinate your withdrawal from a tax point of view.

Conclusion

Annual payments into Pillar 3a are recommended, within the scope of your personal financial possibilities. This allows both your tax and pension situation to be optimized. Pension assets should be regarded and managed together with your other assets, with any withdrawals planned for the long term, because you can achieve further financial advantages this way.

Do you have specific questions on this theme?

Needs and financial objectives change depending on your life phase. With detailed financial planning from our experienced experts, you will be well prepared.

Other important points

We advise you not to look at your Pillar 3a in isolation, but rather in conjunction with your pension fund and free assets. In this way, you can make full use of your options when paying money in, when withdrawing its funds, and when you are planning your estate – and can enjoy more freedom in retirement.

Chiamaci:

|

|

Richiedere un colloquio personaleCompila il modulo di contatto per fissare un appuntamento. |

|

Inviare un’e-mailSaremo lieti di rispondere alle vostre domande per iscritto. |