Investment ideas capturing the Zeitgeist

Don’t be taken by surprise by trends that were foreseeable. Instead, bring the “big picture” into sharper focus by integrating Megatrends into your portfolio.

Alignment with social trends creates new opportunities for investors. The Vontobel “Megatrends” model offers guidance.

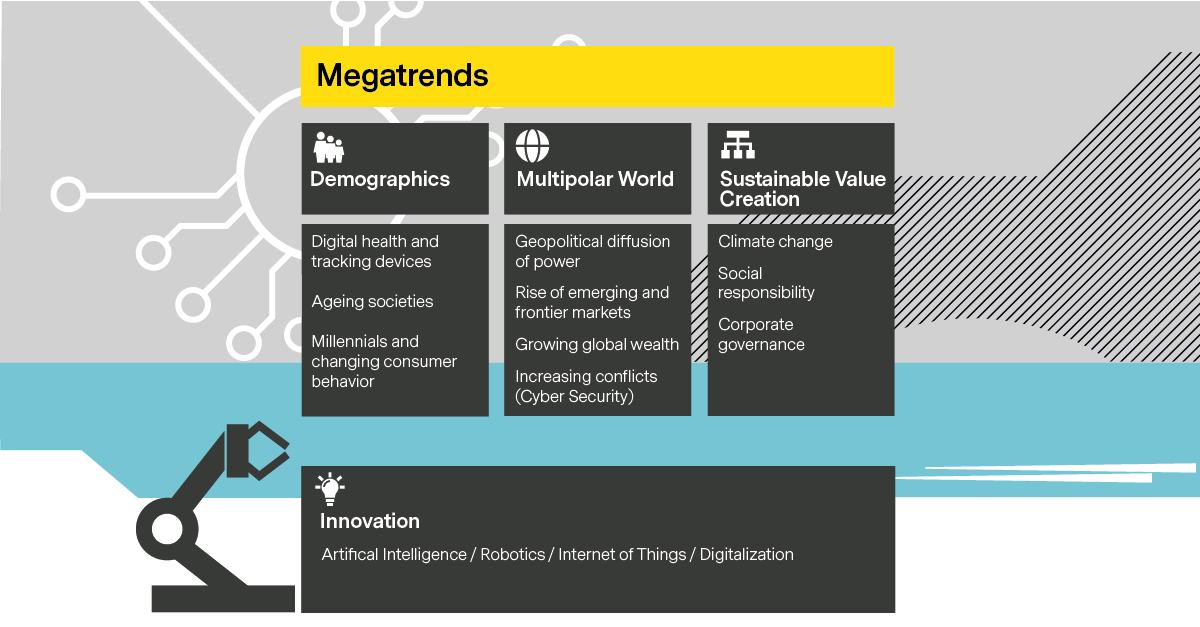

We are currently experiencing long-term social changes that are cropping up in countless areas. Hardly a day goes by without a new industry emerging that revolutionizes established business models or even makes them superfluous. Additional trail-blazing innovations await in areas such as artificial intelligence, robotics or the Internet of Things. Keeping an eye on the future has been the ambition of investors since time immemorial – and the Vontobel "Megatrend" model helps with this.

The model is based on three pillars that, in our eyes, are representative of the changes that we are currently experiencing: demographic change, the emergence of a multi-polar world order, and rules for responsible business. In view of new challenges, the innovative spirit of mankind is called on, which in turn may well express itself for investors in long-term investment trends that show little correlation with global markets.

Consumer behavior, rise of the emerging markets and sustainability as key issues within the Vontobel megatrend model.

Soure: Vontobel

The "silver" generation enjoys better and better physical and mental fitness nowadays, is much more active, and is protected materially at a high level. Companies are responding to this situation increasingly strongly with tailor-made offers such as "smart" clothing that can display health data.

However, the changing consumption behavior of younger adults (millennials), which promotes the development of new trends such as e-sports, is also the focus of this pillar.

The once undisputed supremacy of the United States has increasingly been challenged in recent years from a political and economic perspective. On an economic level, America is seeing itself confronted with the rise of China, but also in India there are clear ambitions to advance the economy appreciably. The development in these two countries, the most populous in the world, is representative of the potential in the emerging markets.

In addition, the ever-increasing networking of computer systems and devices, the unrelenting increase in the flow of data, and threats by radical forces such as hackers are setting new challenges before the economic powers of the world.

Nowadays, almost every listed company has set itself the goal of strategically focusing on environmentally friendly, socially just business committed to the principles of good business management. There are good reasons for this: Companies without such a strategy are often penalized on the stock exchange, and adhering to ESG (Environmental, Social, Governance) standards is becoming an increasingly important component of investment decisions for many.

These developments not only promote innovations in areas such as the smart grid or recycling; they also contribute to the emergence of various investment styles in the wealth management industry.